WHY PHILEO ADVISORY GROUP?

For nearly a decade, we have specifically focused on retirement planning so that our clients only have to retire once. Just as your general practitioner refers you to a specialist, so we are the specialist when it comes to your retirement planning.

Meet Jared Cales

“My business is an extension of my faith and who I am as an individual. Phileo Advisory Group is a way for me to insert a belief into the world that I feel utterly passionate about, and I’m convinced it will have an amazing impact on those I serve.”

Jared Cales

FOUNDER

As a dedicated financial planner, I bring nearly a decade of experience to the table, specializing in empowering individuals and families to retire with confidence. I am committed to ensuring your financial journey aligns with your unique goals and aspirations.

With a focus on serving individuals over the age of 50, I understand the nuanced financial landscape that pre and post retirees face. My mission is to guide you through the complexities of retirement planning, offering tailored solutions that not only protect your wealth but optimize it for a comfortable retirement.

Beyond my professional pursuits, I am dedicated to giving back to the community. I contribute my time by presenting retirement readiness seminars through a local nonprofit organization. These seminars are designed to equip individuals with the knowledge and tools necessary to make informed financial decisions as they approach this pivotal stage in life.

THE PHILEO PROCESS

Initial Phone Meeting

We understand time is valuable. Before diving too deep, it's important for us make sure we're a good fit for each other. No documentation or personal information is needed at this time. It's simply a casual conversation to get to know you.

COMPLIMENTARY Office/VIRTUAL Meeting

Our first meeting is spent understanding your goals, values, needs, and concerns. The information you provide in this meeting will be the guiding beacon for our plan analysis.

Not sure where to start? That's okay! We've helped hundreds of people realize their goals/values as we work through the process.

Second COMPLIMENTARY Office/VIRTUAL Meeting

During this meeting, we will deliver actionable advice and map out exactly what you need to do to achieve your goals in an easy-to-understand fashion.

Once we've demonstrated how we can bring you value, we will review the different approaches for retaining our services and recommend an option that fits your needs.

Think It through

Having been in the industry this long, we know it's a big deal to hire a financial professional and we're in no hurry to ask for your decision right away. Instead, we encourage you to think through some of the following:

1) Do I like/trust this professional?

2) Do I have a clear understanding of what they're going to do for me?

3) Does this professional demonstrate adequate value for the cost?

Onboarding

Once you've had time to think it through, we invite you back to the office to answer any follow-up questions you may have. If you're ready to partner with us, we will begin the paperwork for you to become a client.

Sometimes we make it to this step in the process and determine it's not a good fit. No worries! You'll never receive a hard pressure sale from us, and we will wish you all the best.

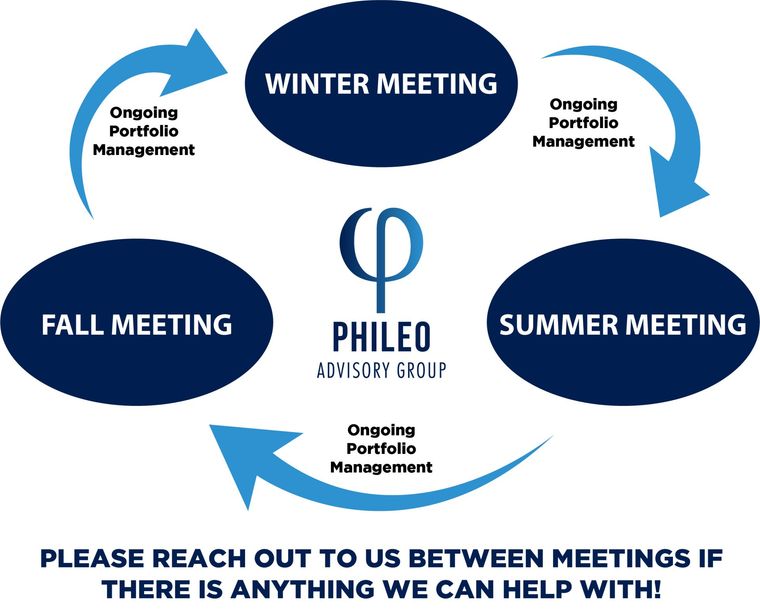

STEWARDSHIP-FOCUSED ONGOING PLANNING SERVICES

Winter Focus Meeting

Financial Planning & Wealth

Management Review

- Client Agenda

- Advisor Agenda

- Identify income/withdrawal needs

- Identify planned expense needs

- Identify plan or portfolio adjustments if/as needed

Spring Focus Meeting

Estate & Risk Management Review

- Client Agenda

- Advisor Agenda

- Beneficiary audits and estate plan reviews (Will's, Trust, POA's)

- Insurance policy review

- Review risk management opportunities

Fall Focus Meeting

Tax & Healthcare Review

- Client Agenda

- Advisor Agenda

- End of year tax planning review

- Identify immediate and long-term tax reduction strategies

- Review employee benefits package and/or Medicare and long-term care policies

Ready to find out if we can help?

We look forward to speaking with you!

Call or email to book a no-cost, no-obligation intro call with Jared Cales at Phileo Advisory Group today.

Investment advisory services offered by duly registered individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Phileo Advisory Group are unaffiliated entities.

Licensed Insurance Professional. This material has been prepared for informational and educational purposes and should not be construed as a solicitation of for the purchase or sell of any investment. The content is developed from sources believed to be providing accurate information. The information is not intended to be investment, legal or tax advice. Different investments involve varying degrees of risk, including and up to the loss of principal. Any references to protection, guarantees or lifetime income refer to insurance products, never securities products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.